Rate Cuts Spark Renewed Buyer Confidence in Toronto Real Estate

In this report, we'll be breaking down the October stats provided by the Toronto Regional Real Estate Board (TRREB). They are specifically for the City of Toronto which includes Etobicoke, Central Toronto, North York, East York and Scarborough.

After a year marked by high listings and subdued sales, October has brought the first real signs of a shift in Toronto’s real estate market. The newest figures suggest that the recent interest rate cuts are beginning to show their impact.

Sales activity jumped significantly, breaking the steady pattern of buyer hesitation that has defined much of 2024. This renewed energy reflects a cautious optimism, as buyers who had been sitting on the sidelines are starting to step back into the market. The year’s trend of abundant listings paired with slower sales seems to be shifting, potentially signalling the beginning of a more active and balanced market dynamic.

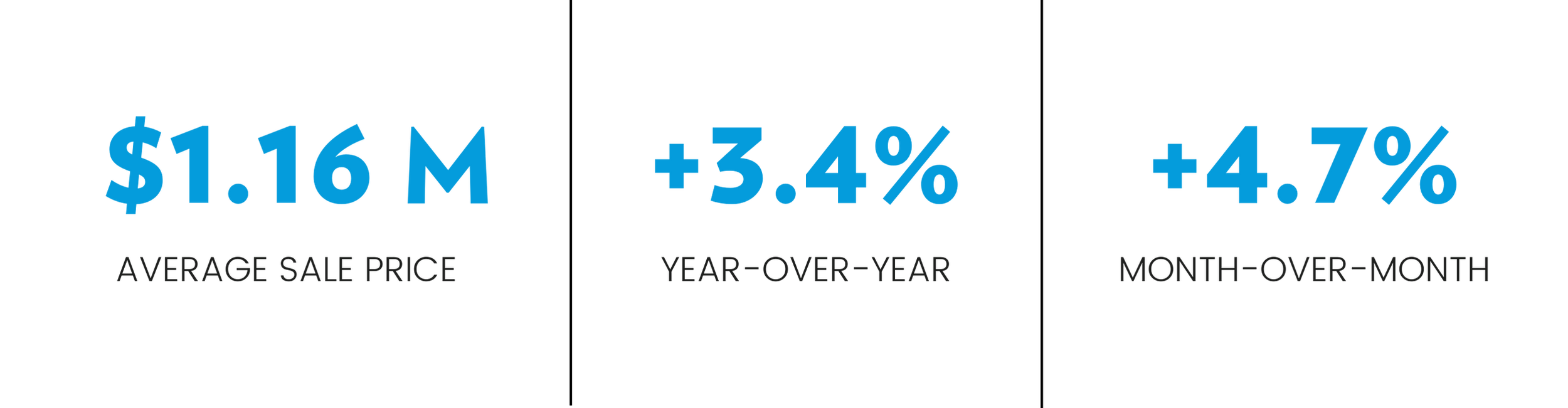

The average sale price for October climbed to $1,165,660, up 3.4% from the same time last year and 4.7% from September.

While steady prices are good news for maintaining equity, they also highlight the importance of strategic pricing and presentation for competing sellers.

For buyers, however, it’s important to note that if conditions continue with higher sales and fewer listings, the opportunities in the market may become less frequent—or more expensive. Acting decisively now can make a significant difference.

Sales surged significantly in October, marking a 36.7% year-over-year increase compared to October 2023 and a notable 38.7% jump month-over-month from September 2024. This shift in activity came almost immediately after interest rates were cut, bringing many buyers back into the market.

For buyers, this means more competition, but also a clear sign that others are seeing this as the right time to make a move. And with listing inventory still high, there are lots of great opportunities still to be had in this market. For sellers, it’s a sign that demand is still there, especially for homes that align with what buyers are looking for.

“While we are still early in the Bank of Canada’s rate cutting cycle, it definitely does appear that an increasing number of buyers moved off the sidelines and back into the marketplace in October. The positive affordability picture brought about by lower borrowing costs and relatively flat home prices, prompted this improvement in market activity,” said Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce.

On the inventory side, October saw 5,959 new listings, reflecting a modest 5.1% increase year-over-year but a noticeable 15.8% dip compared to September 2024. Seasonality may play a role here, as similar patterns were observed last year, with a month-over-month decrease in new listings from September to October but a year-over-year increase during the same period. This trend highlights how the fall market tends to moderate as sellers weigh their options or hold off until the spring. For buyers, this means there’s still inventory to explore, though the number of new listings entering the market may continue to slow as the year winds down.

“Market conditions did tighten in October, but there is still a lot of inventory and therefore choice for home buyers. This choice will keep home price growth moderate over the next few months. However, as inventory is absorbed and home construction continues to lag population growth, selling price growth will accelerate, likely as we move through the spring of 2025,” said TRREB Chief Market Analyst Jason Mercer.

Understanding key real estate market metrics: sales-to-new-listing ratio, days on market, and months of inventory:

The sales-to-new-listing ratio (SNLR) tells us how many of the newly listed properties are being sold in a certain time frame. If the ratio is around 50%, it means the market is balanced. But if it goes above 60%, that's when we start to see a seller's market, where prices tend to rise. So, the higher the ratio, the better it is for sellers and the more competitive the market becomes for buyers.

The average days on market (DOM) refers to the average amount of time that it takes for a property to be sold after it is listed for sale. This can be a useful metric for understanding how quickly homes are being snapped up in a particular area.

Lastly, the months of inventory (MOI) is a measure of the amount of time it would take for all of the currently listed properties to be sold, based on the current rate of sales. It's a useful metric for understanding how much supply there is relative to demand in a particular area. For example, if there are 100 properties currently listed for sale and 20 of them are sold each month, it would take 5 months to sell all of the properties (100 / 20 = 5).

The sales-to-new-listings ratio (SNLR) for October was 38.3%, marking the first time this year the ratio has increased rather than decreased. This uptick suggests a subtle but important shift in the market’s balance. While still indicative of more opportunities for buyers, the increase in SNLR signals that homes are selling more readily compared to earlier months. For buyers, this means staying proactive and prepared in a market that’s just starting to gain momentum.

Properties spent an average of 27 days on the market in October, up from 21 days this time last year, but unchanged from the previous month. Buyers are taking time to deliberate, a trend that aligns with the more balanced conditions we’re seeing. For sellers, patience is key, as homes are still moving—just not at the breakneck pace we’ve experienced in previous years.

Months of inventory stood at 3.8, a notable increase from 2.6 months at this time last year. However, this marks the first time in seven months that the MOI has held steady without increasing further. As of right now, buyers still have some breathing room to consider their options. Sellers should take this into account by ensuring their homes stand out, whether through strategic pricing, upgrades, or staging.

As we head into winter, the usual seasonal slowdown may look a little different this year. Lower rates have spurred activity, and some motivated buyers may continue their search even during the colder months.

Sellers who are prepared to list during this time could benefit from this sustained interest, especially if they’re willing to meet buyers where they are. As we look ahead to 2025, these trends might gradually shift us out of a buyer’s market and toward a more balanced market overall.

These numbers give a city-wide snapshot, but it’s important to note that trends can vary by neighbourhood and home type, with some pockets seeing higher or lower demand.

If you have any questions or would like more information on recent home sales in your specific neighbourhood, don't hesitate to connect with us here.