Average price holds steady as Toronto market skews towards buyers

In this report, we'll be breaking down the June stats provided by the Toronto Regional Real Estate Board (TRREB). They are specifically for the City of Toronto which includes Etobicoke, Central Toronto, North York, East York and Scarborough.

Let’s break down what’s been happening in our market this June. First up, new listings! We’ve seen a 17.8% increase in new listings year-over-year. However, compared to May, there’s been a slight slowdown, with new listings down by 7.3%. This decrease is likely due to the market’s seasonal trends, as real estate activity tends to slow down during the summer months.

“The GTA housing market is currently well-supplied. Recent home buyers have benefitted from substantial choice and therefore negotiating power on price. Moving forward, as sales pick up alongside lower borrowing costs, elevated inventory levels will help mitigate against a quick run-up in selling prices,” said TRREB Chief Market Analyst Jason Mercer.

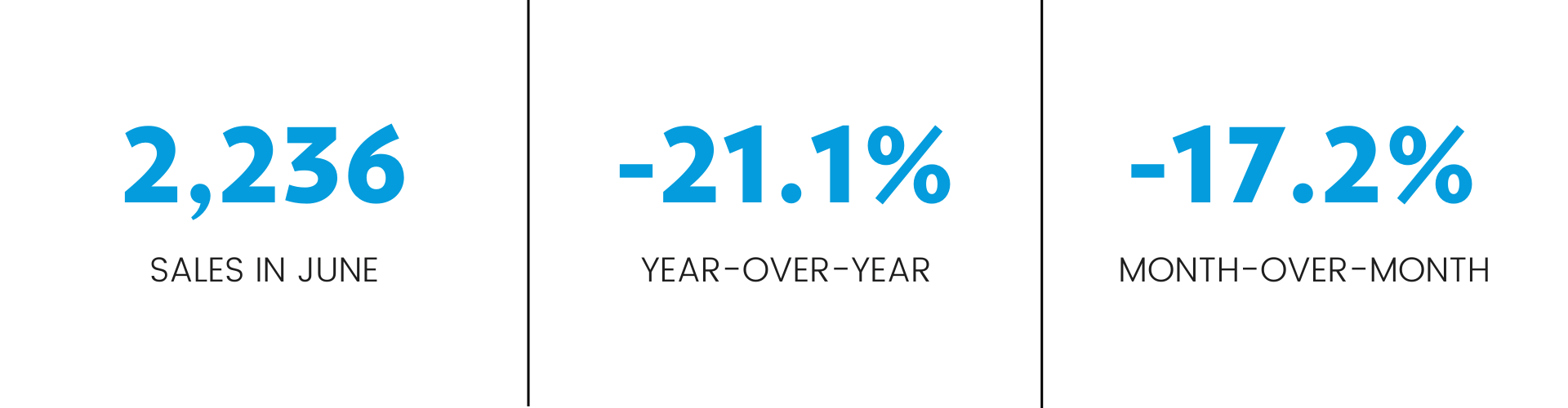

Sales have taken a hit, down 17.2% from May and over 20% compared to last year. While this decrease may partly be due to seasonal trends, it's more likely that buyers are being cautious or waiting for further interest rate drops. The increased number of listings also gives buyers more options, allowing them to take their time making decisions.

“The Bank of Canada’s rate cut last month provided some initial relief for homeowners and home buyers. However, the June sales result suggests that most home buyers will require multiple rate cuts before they move off the sidelines. This follows Ipsos polling for TRREB, which suggested that cumulative rate cuts of 100 basis points or more are required to boost home sales by any significant amount,” said TRREB President Jennifer Pearce.

Despite skewing heavily into buyer market territory, the average sale price has stayed quite steady. There’s been a slight dip from May to June 2024, down by 1.6%. However, on a year-over-year basis, prices have inched up by 1.9%. This indicates a relatively stable market with minor fluctuations. The reasons for this could be:

High-Value Properties Holding Steady: Even with increased inventory, high-value properties may continue to sell at strong prices, which helps keep the average sale price stable.

Sustained Demand in Certain Segments: Specific market segments might still have strong demand, supporting overall price stability.

Seller Confidence and Inventory Control: Some sellers may choose to withdraw their listings if they aren't getting the offers they want, reducing inventory and preventing prices from dropping significantly.

Reluctance to Lower Prices: Sellers might hold off on lowering their asking prices, especially if they believe the market will improve or if they are not in a rush to sell.

Perceived Value: Buyers might still see the current prices as reasonable given the quality and location of the homes, preventing drastic declines. They might also anticipate future price increases, which can lead to stable purchasing patterns.

Understanding key real estate market metrics: sales-to-new-listing ratio, days on market, and months of inventory:

The sales-to-new-listing ratio (SNLR) tells us how many of the newly listed properties are being sold in a certain time frame. If the ratio is around 50%, it means the market is balanced. But if it goes above 60%, that's when we start to see a seller's market, where prices tend to rise. So, the higher the ratio, the better it is for sellers and the more competitive the market becomes for buyers.

The average days on market (DOM) refers to the average amount of time that it takes for a property to be sold after it is listed for sale. This can be a useful metric for understanding how quickly homes are being snapped up in a particular area.

Lastly, the months of inventory (MOI) is a measure of the amount of time it would take for all of the currently listed properties to be sold, based on the current rate of sales. It's a useful metric for understanding how much supply there is relative to demand in a particular area. For example, if there are 100 properties currently listed for sale and 20 of them are sold each month, it would take 5 months to sell all of the properties (100 / 20 = 5).

The Sales to New Listings Ratio (SNLR) has decreased to 38.2% from 39.8% last month and 50.5% last year. This drop suggests a cooling market where fewer listings are being absorbed relative to the number of new listings. A lower SNLR often points to a less competitive market, making it a bit easier for buyers to find what they’re looking for without getting caught in bidding wars.

Average Days on Market (DOM) have increased to 20 days in June 2024, up from 19 days in May and the 15 days we saw last June. Homes are staying on the market longer as buyers take their time to search and make decisions, thanks to the surplus of inventory available.

Finally, let’s talk about Months of Inventory (MOI). The MOI has risen to 3.4 months from 3.2 months last month and 2.4 months last year. This measure indicates how long it would take to sell all the current listings at the current sales pace. An increase in MOI suggests a move towards a buyer’s market, reducing the urgency for quick decisions.

So, what does this mean for you? If you're selling, it's still a good time with prices holding steady. However, it may take a bit longer to find a buyer, depending on the type of property, price, and location. Buyers, you’ve got more options, but don’t take too long to decide – those perfect homes are still moving!

If you have any questions or would like more information on recent home sales in your specific neighbourhood, don't hesitate to connect with us here.