New Listings Reach Yearly High in Toronto's May Real Estate Market

In this report, we'll be breaking down the May stats provided by the Toronto Regional Real Estate Board (TRREB). They are specifically for the City of Toronto which includes Etobicoke, Central Toronto, North York, East York and Scarborough.

The real estate market in the City of Toronto for May 2024 shows a nuanced picture, reflecting a balance of opportunities and challenges for both buyers and sellers.

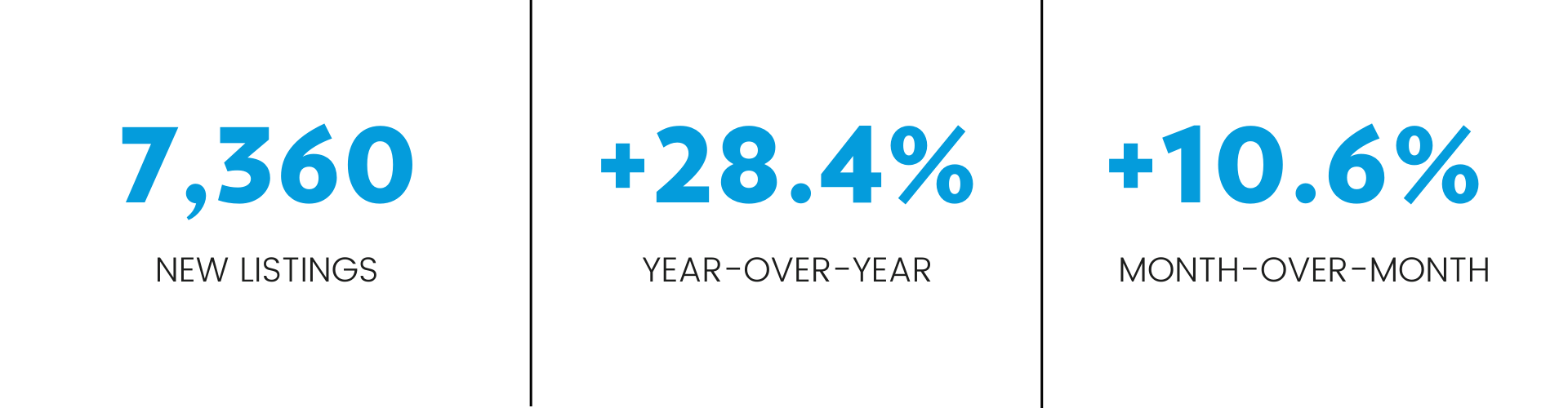

New listings saw a substantial increase, with 7,360 new properties coming onto the market this May, up 28.4% from 5,734 in May 2023. When compared to April 2024, which had 6,655 new listings, this represents a notable month-over-month increase of 10.6%. This surge in listings provides buyers with a greater selection of homes, potentially easing the competitive pressure often seen in Toronto's real estate market.

The number of sales decreased by 17.8%, from 3,285 in May 2023 to 2,701 in May 2024. This decline in sales amidst rising inventory indicates a shift towards a buyer's market, where buyers have more leverage in negotiations.

A positive trend is the month-over-month increase in the number of sales. Starting from January with 1,472 sales, the numbers have steadily increased each month, reaching 2,701 sales in May. This consistent growth indicates a recovering and active market, despite the year-over-year decline compared to 2023. This month-over-month rise suggests growing buyer confidence and increased market activity, which could be partly attributed to the anticipation of the interest rate cut and a seasonal uptick as the market enters the traditionally busy spring period.

"Recent polling from Ipsos indicates that home buyers are waiting for clear signs of declining mortgage rates. As borrowing costs decrease over the next 18 months, more buyers are expected to enter the market, including many first-time buyers. This will open up much needed space in a relatively tight rental market," stated Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce.

The average sale price for all homes in May 2024 was $1,193,202, marking a slight decrease of 0.3% from the $1,197,021 recorded in May 2023. This suggests a stabilizing market, where prices are not increasing or decreasing rapidly, offering a more predictable environment for both buyers and sellers.

If the trend of new listings outpacing sales continues, we might see further downward pressure on average sale prices. An increasing number of new listings without a corresponding rise in sales leads to higher inventory levels. This higher inventory creates more competition among sellers, who may need to lower their asking prices to attract buyers. Additionally, with more choices available, buyers can be more selective and negotiate more aggressively, further contributing to price stabilization or even declines.

Understanding key real estate market metrics: sales-to-new-listing ratio, days on market, and months of inventory:

The sales-to-new-listing ratio (SNLR) tells us how many of the newly listed properties are being sold in a certain time frame. If the ratio is around 50%, it means the market is balanced. But if it goes above 60%, that's when we start to see a seller's market, where prices tend to rise. So, the higher the ratio, the better it is for sellers and the more competitive the market becomes for buyers.

The average days on market (DOM) refers to the average amount of time that it takes for a property to be sold after it is listed for sale. This can be a useful metric for understanding how quickly homes are being snapped up in a particular area.

Lastly, the months of inventory (MOI) is a measure of the amount of time it would take for all of the currently listed properties to be sold, based on the current rate of sales. It's a useful metric for understanding how much supply there is relative to demand in a particular area. For example, if there are 100 properties currently listed for sale and 20 of them are sold each month, it would take 5 months to sell all of the properties (100 / 20 = 5).

In May 2024, the SNLR was 39.8%, a significant drop from 49.4% in May 2023. A lower SNLR typically signals a cooler market with less competition among buyers.

Concurrently, the average days on market (DOM) increased to 19 days in May 2024, up from 16 days in the same month last year. Compared to April 2024, which had a DOM of 21 days, May saw a decrease, indicating homes are selling slightly faster month-over-month. This suggests that while homes are taking longer to sell year-over-year, the month-over-month data shows a slight improvement, offering a positive sign for sellers in an otherwise cooling market.

Another critical indicator is the months of inventory, which rose to 3.2 months in May 2024 from 2.4 months in May 2023. Higher inventory levels mean more choices for buyers and may lead to softer price increases, benefiting those looking to purchase. Sellers, on the other hand, may need to invest more in staging, marketing, and competitive pricing strategies to attract buyers in a more crowded market.

In summary, the Toronto real estate market presents a balanced outlook with opportunities for both buyers and sellers. Buyers benefit from increased choice and potential price stabilization, while sellers need to adopt effective strategies to stand out in a competitive market. The recent interest rate cut by the Bank of Canada adds another layer of complexity, with the potential to invigorate buyer activity and influence market trends in the coming months.

Moving forward, it will be essential to monitor the impact of the interest rate cut on buyer activity. An increase in buyer demand could stabilize or even boost sales volumes in the coming months. Inventory levels will also be a critical factor; continued increases in inventory could further shift the market in favour of buyers.

If you have any questions or would like more information on recent home sales in your specific neighbourhood, don't hesitate to connect with us here.